Qualified Opportunity Zone Fund Investment Economics

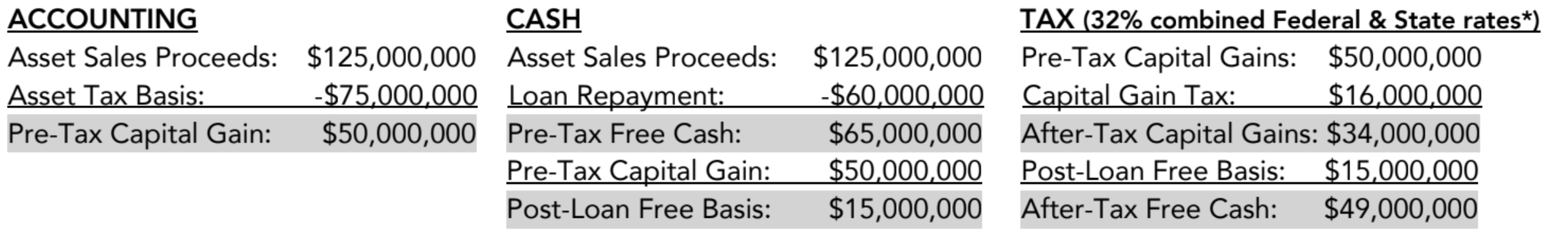

1. Initial Sale of Asset

An Owner of an asset (e.g. Real Estate, Stock, LLC Interests, Art, Cryptocurrency…) sells that asset realizing a capital gain (or an investor could also receive capital gains through an annual partnership K-1 tax filing).

Example:

* Assumes that capital gains tax for federal is 23.8% and for state is 8.2% and that state taxes allow for the usage of the Opportunity Zone Program tax benefits by taxpayers. While the federal capital gains tax rate and Opportunity Zone program tax benefits apply to all US federal taxable investors, state tax rates and benefits may vary. Every investor should check with their accountants as to the rates and benefits that apply for them.

2. Taxes and Investment of Sale Proceeds into a QOF

The Seller in Section 1 may then either:

(i) have unlimited use of the Post-Loan Free Basis (per Example: $15mm) to spend and/or to invest and

(ii) invest the full Pre-Tax Capital Gain (per Example: $50mm) into a tax-advantaged Qualified Opportunity Fund (the “QOF”) within 180 days of the sale of the asset (or if the capital gains were received through a partnership K-1, then within 180 days of the end of the partnership fiscal year)

or

(i) have unlimited use of the Post-Loan Free Basis (per Example: $15mm) to spend and/or to invest and

(ii) pay capital gains taxes (per Example: federal tax rate of 23.8% and state tax of 8.2% totaling 32% for $16mm in total taxes) and then invest the After-Tax Capital Gains (per Example: $34mm) into a QOF or any other investment;

(Note: In order to allow Sellers of property to a QOF portfolio to participate in the tax benefits of investing into that QOF, Sellers of property to a QOF must be less than 20% of the QOF at all times. In order to avoid the potential for sellers tax-benefits to be denied for failing this 20% test, Sellers of property to the Allagash QOF will be offered the opportunity to invest into a QOF-of-One in which they will be the sole investor and which will invest alongside the main QOF in all of the various properties in the QOF portfolio. The investment process and tax benefits described herein are identical for both an investor into the Allagash QOF and a Seller/Investor into a QOF-of One.)

3. QOF Investment Guidelines

At least 90% of the Fund’s assets must be invested into Qualified Opportunity Zone Assets (“QOZAs”) on each of the QOF Testing Dates (June 30 and December 31) after the QOF has begun accepting investor capital. Cash is not considered an acceptable QOZA, however cash which has been newly invested into a QOF will not be considered by this calculation until the second testing date after the investor deposits their cash into the QOF. Effectively, cash invested into a QOF in the first half of any year must be at least 90% invested into QOZAs by 12/31 of that year while cash invested into a QOF in the second half of any year must be at least 90% invested into QOZAs by 6/30 of the following year.

A QOZA can be an investment into either a Commercial Real Estate (“CRE”) property located in an Opportunity Zone (“OZ”) or into an operating business that qualifies as a Qualified Opportunity Zone Business (“QOZB”). With respect to CRE property, the property must be primarily located in an Opportunity Zone (“OZ”) and be either developed for Original Use or renovated and improved with construction expenditure equaling 100% of the amount of Depreciable Property purchased (i.e. the price of the property excluding the price of the land). In the case of renovation and improvement, construction expenditures must be made during some 30-month period in which the property is owned by the QOF and should be finished before the halfway point of the term of ownership by the QOF.

An operating business qualifies as a QOZB if either (i) 50% of its labor input, as per either hours worked or compensation paid, are performed inside an OZ or (ii) if the tangible property of the trade or business located in a qualified opportunity zone and the management or operational functions performed in the qualified opportunity zone are each necessary for the generation of at least 50 percent of the gross income of the trade or business.

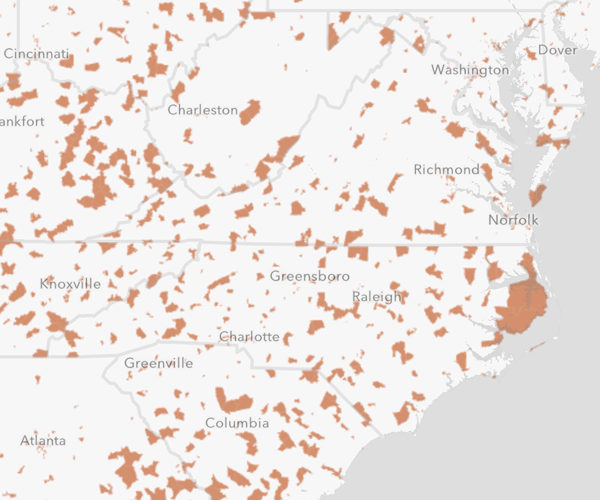

A census tract becomes eligible to be selected as an Opportunity Zone if it has a poverty rate of at least 20% and an Average Median Income (“AMI”) no greater than 80% of the AMI for the state in which it is located. Each governor was responsible for selecting 25% of the eligible census tracts to become Opportunity Zones. OZs are spread throughout urban, suburban, and rural areas of the U.S.

(Note: For owners and sellers of CRE property considering entering into a 1031 exchange to defer capital gains tax liabilities, investing into a Qualified Opportunity Fund and receiving the tax benefits of the Opportunity Zone Program offers four explicit advantages over a 1031 exchange: (i) investors in QOFs do not have to segregate sales proceeds in advance of investing into the QOF, (ii) investors in QOFs have full use of their initial investment basis only having to reinvest capital gains, (iii) investors in a QOF can step-up basis after 10 years versus requiring a generational estate transfer, and (iv) investors in QOFs can achieve significant asset diversification.)

4. Initial Capital Gains Tax Deferral

Upon investing into a QOF with capital gains generated by a previous sale of assets or received through a partnership interest K-1 statement, an Investor will have the Capital Gain Tax liability (per Example: $16mm) (i) deferred to the earlier of 12/31/2026 or the date of the sale of the QOF interests (or liquidation of QOF assets, as may be the case) and (ii) potentially reduced by up to 15% subject to the following guidelines:

- If the Investor remains invested in the QOF for less than 5 years, the initial tax liability upon sale will be the QOF sale proceeds multiplied by the applicable state & federal capital gains taxes rates (per Example: 23.8% and 8.2% respectively) (i.e. investment gains or losses will proportionally increase or decrease the amount of capital gains taxes that had been deferred).

- If the Investor remains invested in the QOF for at least 5 years but less than 7 years, then the tax liability upon sale will be either

- if the QOF sale proceeds are above the initial investment amount (per Example: $50mm), 90% of the initial tax liability (per Example: $14.4mm) plus the appreciation of the QOF interests multiplied by the applicable state & federal capital gains tax rate; or

- if the QOF sale proceeds are below the initial investment amount, the lesser of (a) 90% of the initial tax liability or (b) the QOF Sale proceeds multiplied by the applicable state and federal capital gains taxes rates

- If the Investor remains invested in the QOF for over 7 years, the tax liability will be:

- If the QOF has appreciated from investment through 12/31/2026, then

- for the 2026 tax year, 85% of the initial tax liability (per Example: $13.6mm) will be due; plus

- if the QOF interests are sold within 10 years and the QOF has appreciated from investment through sale, then upon sale, that appreciation of the QOF interests’ value multiplied by the applicable state & federal capital gains tax rates (if holding over 10 years, see Section 6).

- If the QOF fair market value (“FMV”) has decreased from investment through 12/31/2026, then

- for the 2026 tax year, the lesser of (a) 85% of the initial tax liability or (b) the QOF FMV multiplied by the applicable state and federal capital gains taxes rates; plus

- if the QOF interests are sold within 10 years and the QOF has appreciated from 10/31/2026 through sale, then upon sale, that appreciation of the QOF interests’ value multiplied by the applicable state & federal capital gains tax rate (if holding over 10 years, see Section 6).

- If the QOF has appreciated from investment through 12/31/2026, then

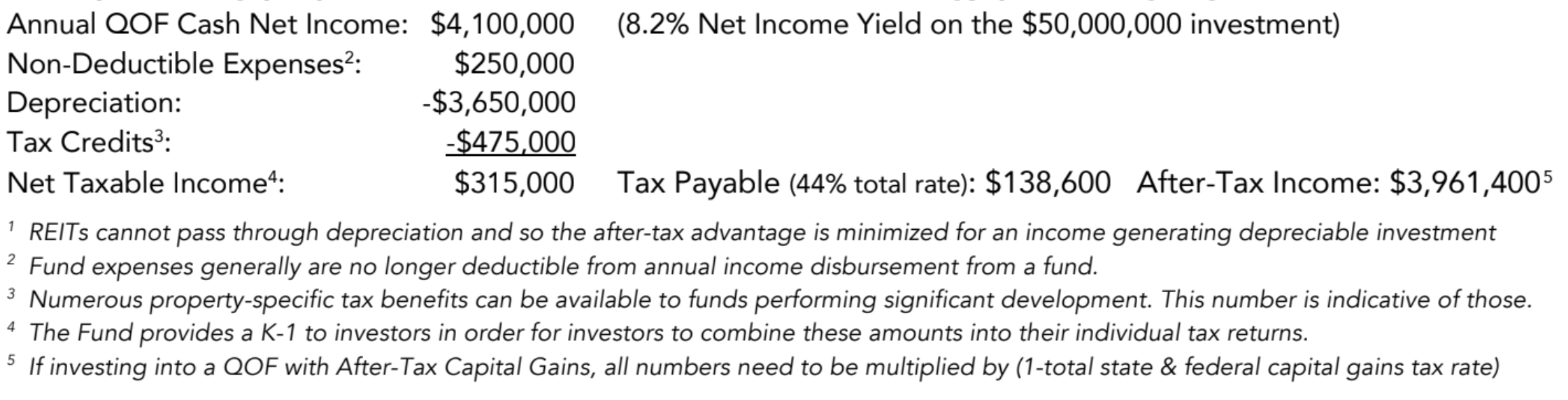

5. Income Taxation

Private Equity Real Estate funds1 are pass-through entities for tax purposes and can be expected to pass through income and depreciation (as well as any tax credits from other programs, if available) each year.

Example (using projected cashflows of a renovation strategy producing high current income):

6. QOF Tax-Free Capital Gains

Finally, if the QOF Investor remains invested in the QOF for at least 10 years and pays the deferred capital gain tax from the sale of their initial asset (per Example: 85% of $16mm equaling $13.6mm) with their 2026 tax payment, then the Investor is exempt from paying capital gains taxes (or any associated depreciation recapture taxes) on any gain recognized from selling/liquidating their QOF investment.

Conclusion: OZ Investment Results v. After-Tax Investment Results

Assuming that an Investor does not invest the Post-Loan Free Basis (per Example: $15mm) but only the Capital Gain portion (per Example: $50mm) of the Sale Proceeds, then two scenarios can be compared:

Scenario 1: Investing the Pre-Tax Capital Gains into a QOF with investor planning pay the deferred capital gains taxes by using the QOF Interests as collateral to borrow the tax amount from a 3rd party lender when the taxes are due with the 2026 tax payment and then paying back that loan plus 6% compounded interest from QOF disbursements upon QOF sale/liquidation in year 11; or

Scenario 2: Investing the After-Tax Capital Gains (per Example: $34mm after paying 32% state and federal capital gains taxes on the $50mm Pre-Tax Capital Gains) into the same QOF.

Assuming that the QOF generates an 8.2% average annual Net Income Yield (as per Example in Section 5) which accumulates to 0.9x return of invested capital from income with that income almost completely offset for tax purposes by depreciation and tax credits (as per Example in Section 5) and further assuming a 2.7x Net Capital Return to the Investor upon QOZA portfolio liquidation in Year 11, then the Investor would have total net return of capital of 3.6x the invested amount with the following after-tax value in each scenario:

Scenario 1: INVESTMENT OF PRE-TAX CAPITAL GAIN (OZ program tax benefits): $50,000,000 invested

Income

Annual After-Tax Cash Income (100% of After-Tax Income in Footnote #4, Section 5): $3,961,400

Accumulated After-Tax Income Future Value (over 11 years): $43,575,400

Capital Gain

Year 11 QOF Liquidation Proceeds (Return of Basis + Capital Gain): $136,500,000

Year 11 Capital Gain and Depreciation Recapture Taxes: -$0

Loan for Initial Capital Gain Taxes repaid from Year 11 proceeds: -$17,170,000

Net Year 11 After-Tax QOF Liquidation Proceeds: $119,330,000

Total Investment Return Value: $162,905.400

Scenario 2: INVESTMENT OF AFTER-TAX CAPITAL GAIN (no OZ Program tax benefits): $34,000,000 invested

Income

Annual After-Tax Cash Income (from Footnote #4, Section 5): $2,694,000

Accumulated After-Tax Income Future Value (over 11 years): $29,634,000

Capital Gain

Year 11 QOF Liquidation Proceeds (Return of Basis + Capital Gain): $92,820,000

Year 11 Capital Gain and Depreciation Recapture Taxes: -$27,832,000

Net Year 11 After-Tax QOF Liquidation Proceeds: $64,988,000

Total Investment Return Value: $94,622,000

As illustrated above, an investor with currently taxable capital gains who takes advantage of the Opportunity Zone Program by investing those capital gains on a pre-tax basis into a Qualified Opportunity Fund with the above return characteristics for the full 11-year investment period is projected to increase the value of their future wealth by an additional 1.36x the initial available Pre-Tax Capital Gains compared to having invested into the same QOF on an after-tax basis without taking advantage of the benefits of the Opportunity Zone program. (per Example: ($163mm-$95mm)/$50mm = $68mm = 1.36x $50mm)

Investors must consult their own tax advisors before investing in any Qualified Opportunity Zone Fund.

CONTACT

Tony Barkan

CEO / Co-Managing Principal

Allagash Opportunity Zone Partners LLC

(646) 946-0482

tbarkan@allagashoz.com

DISCLAIMER

This presentation does not constitute an offer to sell, or a solicitation of an offer to buy the limited partnership interests or securities of any funds described herein. No such offer or solicitation will be made prior to the delivery of confidential offering memoranda and other materials relating to the matters described herein. Before making an investment decision with respect to the such interests or securities, potential investors are advised to read carefully the confidential offering memorandum, the limited partnership agreement, if any, and the related subscription document (collectively, the “Offering Documents”), and to consult with their tax, legal and financial advisors. This presentation contains a preliminary summary of the purpose of the funds and certain business terms; this summary does not purport to be complete and is qualified and superseded in its entirety by reference to a more detailed discussion contained in the Offering Documents. The General Partner or the Investment Manager, as the case may be, has the ability in its sole discretion to change the strategy described herein and is not required to update or revise the presentation except by means of the Offering Documents. Information presented herein is as of the date hereof unless otherwise indicated.

References to specific investments or strategies are for illustrative purposes and are not intended to be and should not be relied upon as a recommendation to purchase or sell particular investments or engage in particular strategies. The references to specific securities or investment vehicles are not a complete list of all investment vehicles or positions in the portfolios and the positions or strategies identified herein may or may not be profitable. No representation is made that any portfolio will contain any or all of the investments identified herein, that any of such investments will actually be available for investment at such levels or in such quantities. The presentation was prepared using certain assumptions which are based on current events and market conditions, and as such are subject to change without notice, and we assume no obligation to update the information. Changes to the portfolio or the assumptions and/or consideration of additional or different factors may have a material impact on the results presented. Not all assumptions have been considered in compiling this data. Actual events are difficult to predict and may differ from those assumed for purposes of this presentation. There is no representation or guarantee regarding the reliability, accuracy or completeness of this material, and neither Allagash Opportunity Zone Partners LLC, its affiliates nor their respective members, officers or employees will be liable for any damages including loss of profits which result from reliance on this material.

There are certain risks associated with an investment in private funds. For example, such funds can experience volatile results and an investor or limited partner could lose some or all of his investment. A fund investment is very speculative and involves a high degree of risk, not suitable for all investors. Further such an investment is illiquid, due to restrictions on transfer, the lack of registration and the absence of a current or expected secondary market for fund securities, interests, or shares. Investment strategies may include non-performing/distressed illiquid assets, employ leverage and/or a shorting strategy. High management fees and an incentive fee or allocation may cause the manager to take greater risks than it ordinarily would without such fees. This is not a complete description of the risks associated with a hedge fund investment.

There are certain risks associated with investment strategies that rely upon tax rates. Any particular investor’s tax rates may vary significantly from the rates shown. Legislation or IRS procedure may invalidate any assumptions with respect to tax rates that are being referred to. All examples are for illustrative purposes only. Investors should consult their tax advisors independently.

This presentation is being provided to a limited number of eligible investors on a confidential basis. Accordingly, this document may not be reproduced in whole or in part without the prior written consent of Allagash Opportunity Zone Partners LLC. Past performance is no guarantee of future results. Individual investor performance may vary by investor. To the extent that target returns are included, there is no assurance that such targets can be achieved or that actual results will not differ, perhaps materially, from such target returns. Other Allagash Opportunity Zone Partners LLC’s managed funds or investment opportunities may experience results which differ, perhaps materially, from those presented, due to different investment objectives, guidelines and market conditions.

Copyright © 2019 Allagash Opportunity Zone Partners LLC. All Rights Reserved.